31+ Personal loans with fair credit

Credit card debt typically carries higher interest rates than personal loans. What Is the Fair Credit Reporting Act.

Pin On Family Fun Food Frugality Group Board

While borrowers may not have perfect credit scores they usually have a fair or decent score and a steady income.

. The FCRA is chiefly concerned with the way credit reporting agencies use the information they. Federal credit unions may also offer members payday alternative loans for amounts between 200 and 1000. Flexible repayment terms and a range of interest rates mean that you can find a loan offer that makes.

Most personal loans require a score of at least 660 for approval so having a 650 credit score constrains your options. Compare rates from lenders to get the best deal. Wells Fargo offers unsecured loans and its maximum loan amounts are higher than what youll find at some.

247 Lending Group works hard to put the personal back into personal loans by cultivating relationships with lending partners and borrowersThe lending network offers various loan options for borrowers of every credit rating including debt consolidation loans. While several lenders also offer personal loans for poor or fair credit remember that these loans will generally come with higher interest rates compared to good credit loans. Why Wells Fargo stands out.

Meanwhile you may be able to get a personal loan with fair or poor credit but at the cost of less favorable rates. Bad credit personal loans are the focus of this content. TransUnion reports lenders approved a record number of credit cards and personal loans in the.

Best for large loan amounts. You can use both personal loans and credit cards to cover a variety of expenses. Blog Credit Repair.

These are often called signature loans because you just need to sign your name to the loan agreement form to complete the transaction. Any loans you do. Personal Loans vs.

Available only for the most creditworthy borrowers. Low-interest credit cards and personal loans are useful in different situations. Those with fair to bad credit scores below 690 may have to look a little harder and pay a higher rate for a personal loan.

Limited to new vehicles and used vehicles nine model years old or newer. Contact the credit union for terms on auto loans for vehicles ten years old or older. Just remember that PNCs personal loans have fixed rates while its lines of credit have variable rates.

Fair or thin credit. This allows lenders to offer lower interest rates because they trust that the borrower is more likely to repay the loan. Read our full review of PNC personal loans to learn more.

If youre a member of a credit union or if you can join one you may be able to access lower-interest personal loans. Fair Good Excellent 350-650. 7 min read Aug 31 2022.

In both loan and credit card. Personal loans and credit cards both offer a way to borrow funds and have many of the same standard credit provisions. The Fair Credit Reporting Act FCRA is a federal law that regulates credit reporting agencies and compels them to insure the information they gather and distribute is a fair and accurate summary of a consumers credit history.

Find your bad-credit loan today. And paying down credit card debt will almost certainly raisenot loweryour credit score. 2022 to July 31 2022.

Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. Loans for Good Credit. The minimum credit score required by these lenders is either equal to or lower than 650 which is in the fair credit range.

Notice Of Furnishing Negative. Bad Credit Personal Installment Loans in Ohio. Find news and advice on personal auto and student loans.

NerdWallet helps you compare bad-credit personal loans from lenders that accept borrowers with bad fair or thin credit. People with poor to fair credit may end up paying higher interest rates on their personal loans than on their credit cards especially for loans that dont have a minimum credit score. Personal loans are ideal for a one-time expense that you need a few years to.

All loans subject to approval and rates terms restrictions and conditions are subject to change. Loans to Gen Z consumers increased by 316 between the first quarter of 2021 and the first. Best for fair credit.

Rates are estimates only and not specific. If you have poor credit or no credit history you may need to get a co-signer. These typically come with terms up to six months an application fee of no more than.

For this matter there are some consumers who choose to transfer personal loans to a credit card. Payday alternative loans. Loans for Fair Credit.

2

102 Split Hoof Trl Prudenville Mi 48651 Mls 201819614 Zillow

31 Free Personal Finance Homeschool Resources

31 Commonly Missed Tax Deductions For Stylists Barbers And Beauty Professionals The Handy Tax Guy

G201504061231509392619 Jpg

Free 31 Sample Application Forms In Pdf Ms Word Excel

Concept And Meaning Of Suspense Account And Utility Of Suspense Account Electrospun Materials And Polymeric Membranes Research Group

Axos Financial Inc Free Writing Prospectus Fwp

Unsecured Business Loans For Startups Business Finance For Bad Credit

Img008 Jpg

31 Commonly Missed Tax Deductions For Stylists Barbers And Beauty Professionals The Handy Tax Guy

31 Facts About Fafsa For Parents Sofi

31 Free Personal Finance Homeschool Resources

Agreement Templates 31 Free Word Pdf Documents Download

31 Commonly Missed Tax Deductions For Stylists Barbers And Beauty Professionals The Handy Tax Guy

Amazon Com Autel Maxipro Mp808bt Diagnostic Scanner 2 Years Free Updates 700 Bucks Upgraded Of Mp808 Ds808 Ms906 Ecu Coding Vag Guided Wireless Oe Level Diagnostics Bidirectional Control 30 Services Automotive

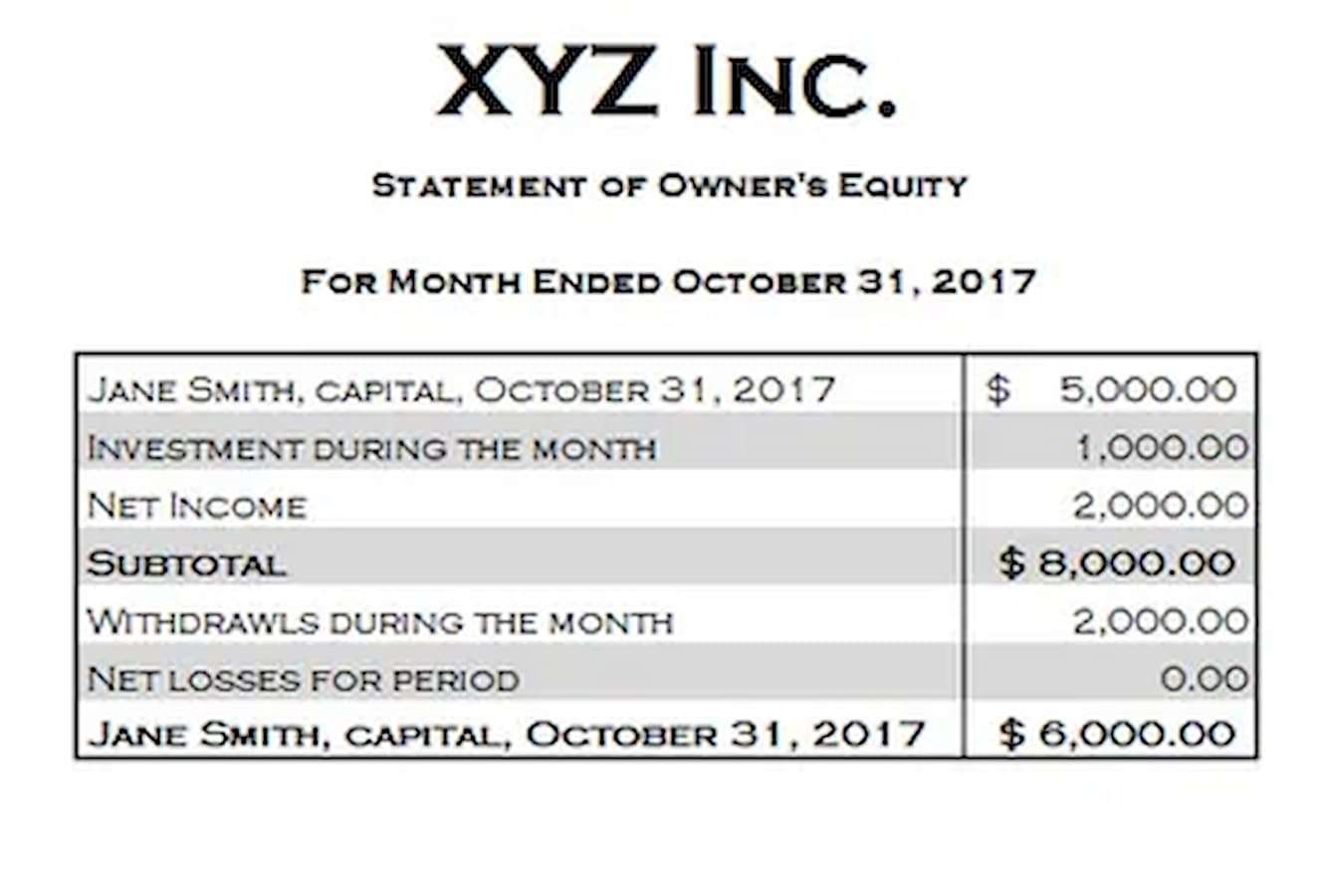

31 Statement Forms In Ms Word Pdf Excel